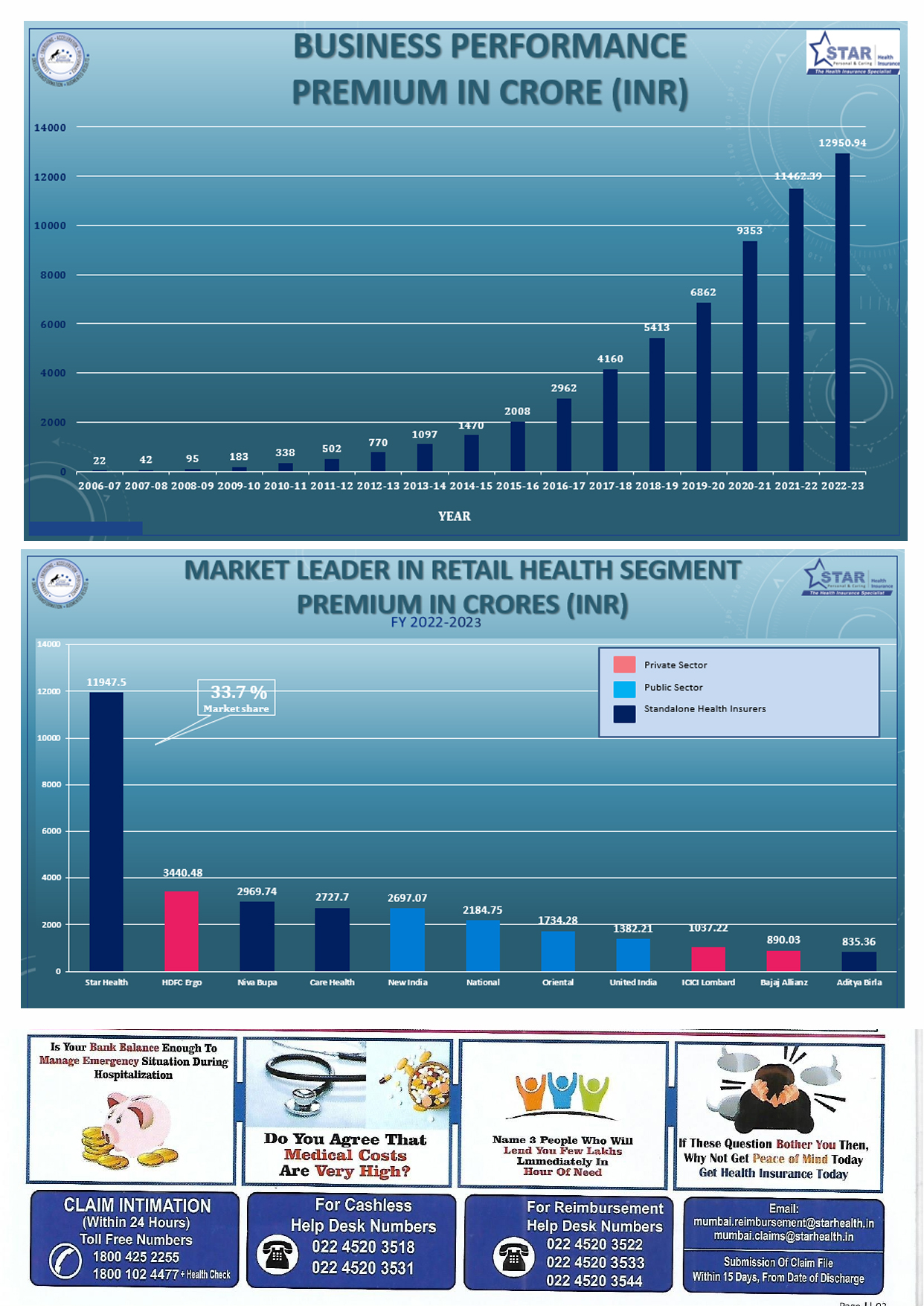

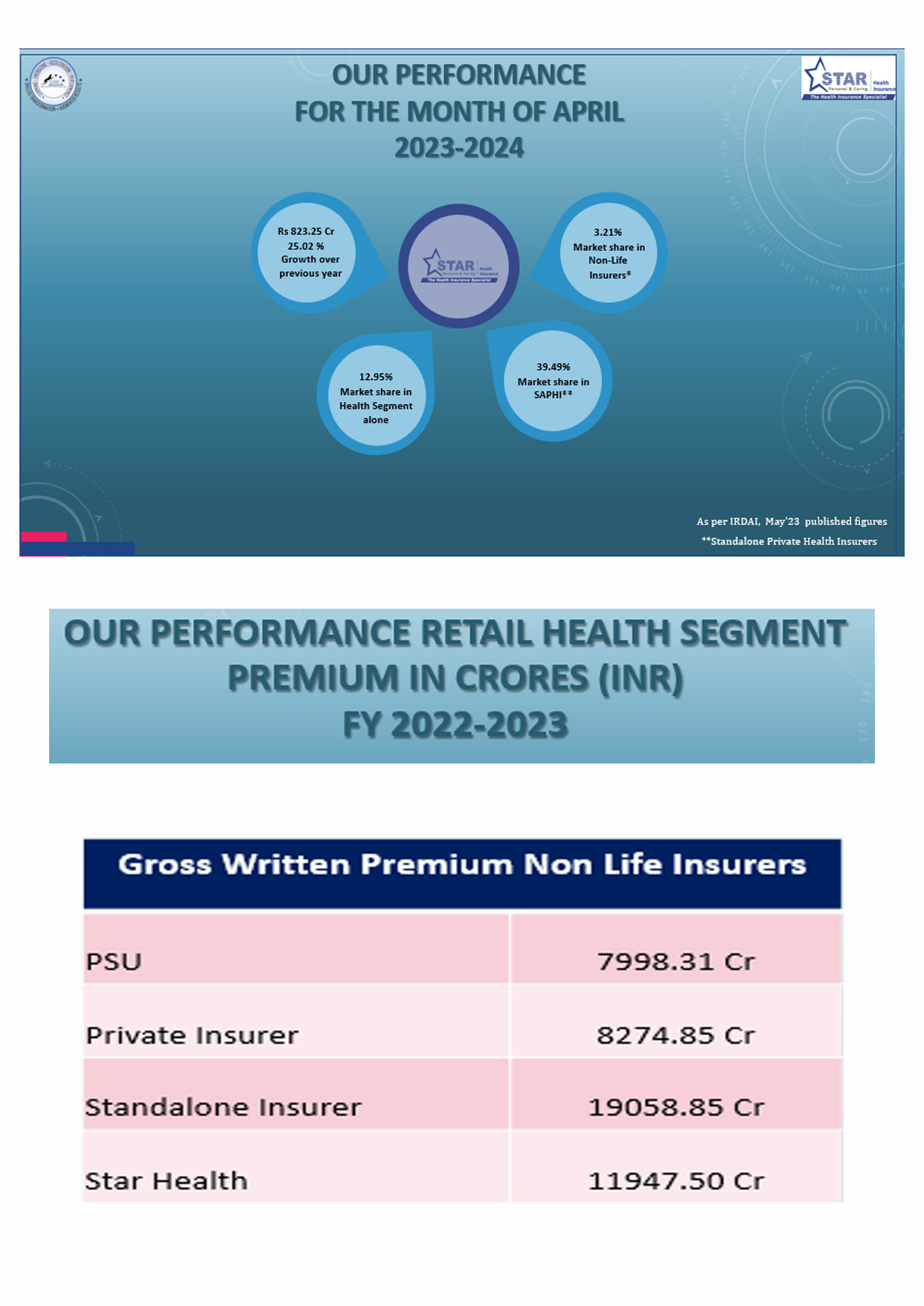

Star Health and Allied Insurance Co. Ltd. is India’s first Standalone Health Insurance provider which commenced its business in 2006. Today, the company has become a market leader which offers multiple insurance products including Health, Personal Accident and Overseas Travel Insurance etc., thereby fulfilling varied needs of different sections of the society.

It is also prominently into bancassurance with long standing relationships with several Indian banks. With more than 10,600 employees and 550 branches across the country, In the Indian insurance industry, Star Health Insurance has become a trusted brand. Health Insurance is one of the most promising segments in which the company operates.

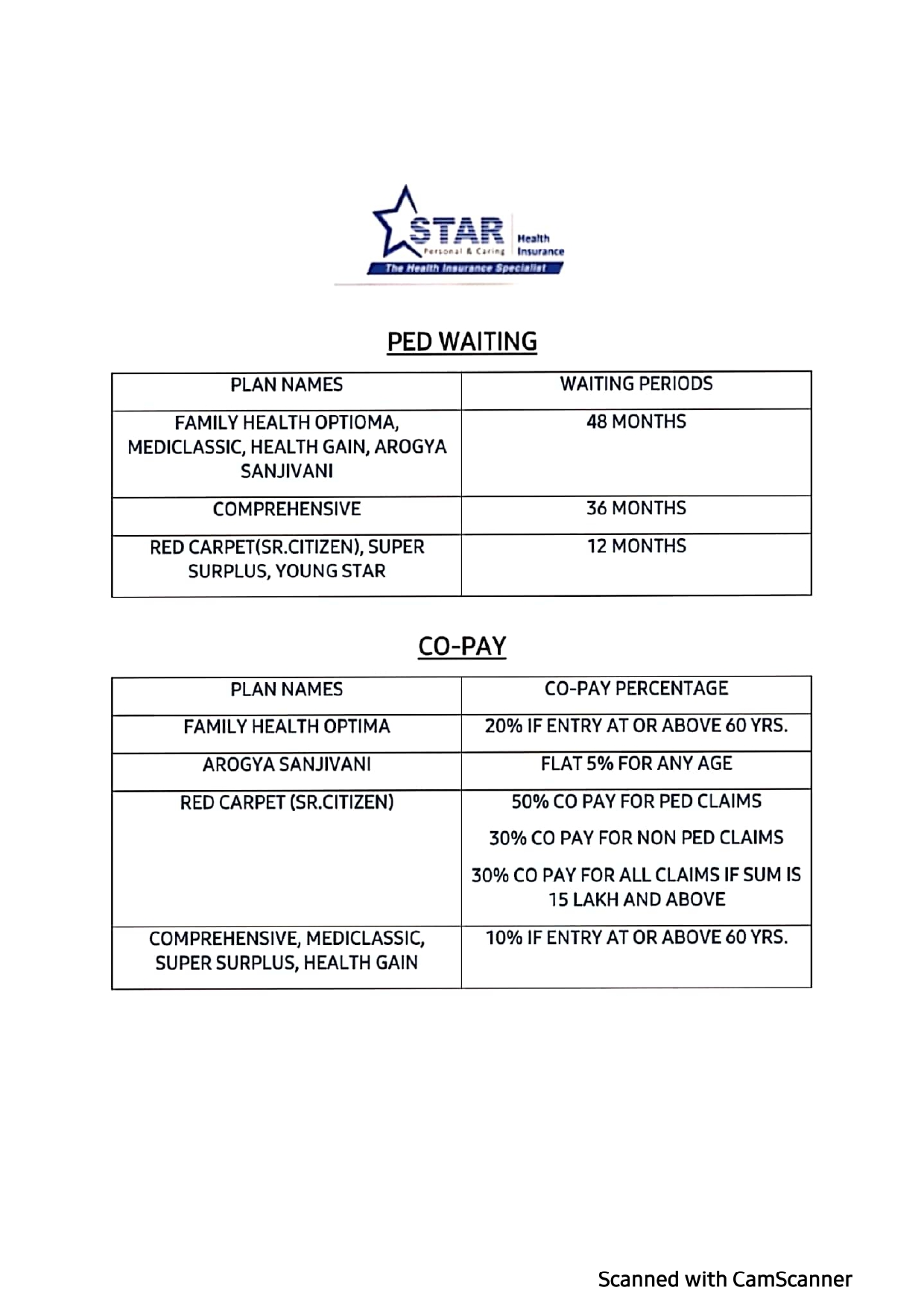

Star Health Insurance offers a wide range of affordable health insurance products for individuals, families, and corporations. The plans cover the insured for medical check-ups, AYUSH systems of medicines, critical illnesses, and hospitalization expenses. Also, now you can find coronavirus coverage under health insurance plans offered by Star health Insurance. The company also offers health insurance plans for autistic children which makes its offerings unique. One of the key advantages of buying Star Health Insurance plans is that those under the age of 60 do not have to pay a copayment.

Check out some of the unique benefits of the Star Women Care Insurance policy:

Unlike most health insurance plans, pregnant women can buy this policy as long as they submit the scan reports taken between their 12th and 20th week of pregnancy.

This health insurance for women covers a wide range of maternity-related benefits, including delivery expenses, newborn baby cover, assisted reproduction treatment, in utero fetal surgery/repair, accidental miscarriage, etc.

In case of partial or full utilization of the sum insured, the amount will be automatically restored by 100% once in the lifetime of the policy.

The insured will be eligible for a preventive health check-up benefit every year under this policy.

If no claim is filed in the last policy year, the policyholder will be granted with a 20% cumulative bonus for a maximum of 100%. This bonus will increase their renewal sum insured without paying a higher premium amount.

A daily allowance of Rs 2000 per day will be given to the policyholder if he/she opts for shared accommodation in the hospital. This benefit is payable for up to a maximum of seven days.

A Star Women Care Insurance policyholder can avail cashless hospitalization facility at over 12000 network hospitals of the insurance company across India.

The Star Wellness Benefit promotes a healthy lifestyle by giving wellness points to the insured for developing healthy habits through a range of wellness activities. The higher are the wellness points, the higher will be the discount on the premium.

Women interested in buying this Star Health Insurance policy do not need to undergo a pre-acceptance medical check-up.

Under Section 80D of the Income Tax Act, the premium paid towards Star Women Care policy can be claimed for tax savings.

The entire family can be insured under the Star Comprehensive health plan as long as they fall into the age group of 3 months and 65 years. However, dependent children between the age of 3 months to 25 years can only get medical cover along with their insured parents.

Following are the key features and benefits of the Star Comprehensive Health Insurance policy:

Star Comprehensive Health Insurance plan comes with the below coverage:

Pre-hospitalization expenses for a maximum of 60 days before getting admitted

Post-hospitalization expenses for a maximum of 90 days of getting discharged from the hospital

Hospitalization expenses can be claimed, including room charges, boarding charges, cost of nursing, anesthetist’s fee, surgeon’s fee, specialist’s fees, cost of drugs, pacemaker, and medicines.

AYUSHhospitalization expenses including Homeopathy, Ayurveda, Unani and Siddha are payable under this policy.

Emergency road ambulance transportation charges are also covered.

Both normal and cesarean delivery expenses are claimable.

Newborn baby and vaccination expenses are also covered.

Star Comprehensive health plan also covers organ donor charges.

In case of emergency, air ambulance charges are covered as well.

Being a comprehensive health plan, it also included domiciliary hospitalization

Health check-up facilities are also available

The insured can file a claim for accidental death and permanent total disabilities.

Dental/ophthalmic OPD treatment covered once in every 3years

Bariatric surgery expenses can also be claimed after the completion of awaiting period of 3 years

Second medical opinion taken from the Star Health Insurance network of doctors can be reimbursed

Hospital cash benefit for up to 7 days is provided in case of hospitalization

Star Red Carpet senior citizen health plan is perfectly designed for elderly people above the age of 60 years. There is no need for any pre-medical screening before buying this health insurance policy, which proves to be a boon for senior citizens. Check out what this policy has to offer to people between the age group of 60 and 75 years.

Individuals between the age group of 60 and 75 years of are eligible to get coverage under Star Red Carpet senior citizen health plan.

One of the most popular plans, Star Red Carpet Senior Citizen Insurance offers the following coverage benefits to the insured:

To Buy this plan Click Below

Star Family Health Optima Health insurance plan offers wide coverage to the entire family under a single plan. It is a complete medical protection plan that covers the policyholder and the entire family on a floater basis. Due to sedentary lifestyles, people are now more vulnerable to health issues and the cost of medical treatment is also exorbitant. This comprehensive and affordable plan helps to pay the hospital bills of the entire family.

The key features and benefits of the Star Family Health Optima plan are as follows:

The coverage provided in the Star Family Health Optima Insurance plan are as follows:

Take a look at the eligibility criteria of the Star Family Health Optima plan below:

To Buy this Plan Click here .

The insurance company will take care of the following expenses during the policy term.

Expenses arising due to your stay in the hospital –

Treatment of Cataract will be covered up to a specified limit as shown below –

| Sum Insured (In INR) | Per Eye (In INR) | Per Policy Year (In INR) |

|---|---|---|

| 10, 20 or 30 Lakhs | 50000 | 80000 |

| 50 Lakh and more | 60000 | 1 Lakh |

If a claim is admissible for the basic cover, the company shall also cover the non-medical items. Such items are – mineral water, food (other than the one provided by the hospital), braces/belts, laundry, attendant charges, thermometer, Nebuliser kit, etc.

In case of an accident or a situation where the patient can’t reach the hospital on his own, ambulance service is provided. And at an age of 50 years and above, the human body strength decreases. So, taking care of the insured, this cover is provided. The insurer shall cover this if the insured has made an admissible hospitalization claim. Road ambulance expenses are payable for transportation to the hospital, from one hospital to another for better medical treatment or from the hospital to home. A medical practitioner needs to certify the same to get transportation coverage.

If you’re evacuated through an air ambulance, you can later seek reimbursement of expenses incurred towards the same for up to INR 2,50,000 per hospitalization. And this benefit is subject to a maximum of INR 5 Lakh per policy year. You can avail of this benefit by filing an admissible hospitalization claim.

The medical bills of 60 days before the hospitalization will be reimbursed to you. You’ll get the same benefit for the expenses incurred up to 90 days following the discharge from the hospital.

Star Health Premier Insurance Policy covers organ transplantation where the donor incurs expenses for complications requiring a redo surgery or ICU admission. The coverage limit under this benefit is over and above the sum insured. The additional sum insured is for the donor and not the insured.

Treatment of diseases, illness or accidental injuries by AYUSH treatment (Ayurveda, Yoga, Unani, Siddha and Homeopathy) are covered up to the sum insured under this policy.

When the insured undergoes a bariatric surgical procedure, the company will cover its cost as well as its complications thereof. This benefit is available after a waiting period of 24 months. For a sum insured of INR 10 and 20 Lakh, the limit is INR 2.5 Lakh. And if the sum insured is more than INR 20 lakh, the limit rises to INR 5 Lakh.

Star will cover the following treatments up to 50% of the sum insured –

If a medical treatment including AYUSH at home lasts for more than three days, the insurer will cover it. However, the policy shall not cover –

Under this section, the medical expenses are covered up to 10% of the sum insured. For rehabilitation benefits, you need to take treatment at an authorized center if you file an in-patient hospitalization claim for any of the following.

Up to 10% of the sum insured is payable, subject to a maximum of INR 5 Lakhs, when you visit the Star network facility for treatment. This benefit is payable once in a lifetime for each insured. To get this benefit, you need to spend 24 months continuously under the Star Health Premier Insurance Policy. The decision of the medical panel will be final for this benefit.

At old age we suffer from many diseases and the recovery can take a lot of time. If you seek treatment at home as per the doctor’s advice, up to 10% of the sum insured, subject to a maximum of INR 5 Lakhs, will be payable to you.

The company will take care of the expenses of your health check-up up to the limit as mentioned below –

| Sum Insured (In INR) | Individual Policy (In INR) | Family Floater (In INR) |

|---|---|---|

| 10 Lakh | 3000 | 4000 |

| 20 Lakh | 4000 | 6000 |

| 30 Lakh | 4500 | 6500 |

| 50 Lakh | 5000 | 7500 |

| 75 Lakh | 7000 | 10000 |

| 1 Crore | 7000 | 10000 |

If you’re admitted as an outpatient, the payable amount from day one is as follows.

| Sum Insured (In INR) | Individual Policy (In INR) | Family Floater (In INR) |

|---|---|---|

| 10 Lakh | 3000 | 4000 |

| 20 Lakh | 4000 | 6000 |

| 30 Lakh | 4500 | 6500 |

| 50 Lakh | 5000 | 7500 |

| 75 Lakh | 7000 | 10000 |

| 1 Crore | 7000 | 10000 |

Want to Buy this plan Click here

Star Health and Allied Insurance Co Ltd began its services in 2006 with the interests in Overseas Mediclaim Policy, Health Insurance, and Personal Accident. The company allows a broad range of health insurance products at reasonable costs to make health insurance every human being's fundamental right.

The Star Health Super Surplus plan gives you more coverage than other basic plans. It offers wider protection at a lesser price. The policy is available for both individual and family floater basis.

Star Mediclassic Insurance from Star Health and Allied Insurance Company covers for hospitalisation expenses incurred as on illnesses, diseases, and accidental injuries. The insured can also avail cashless treatment in more than 9900 network hospitals. One major benefit is that all the Star health mediclaim policy claims are settled directly by the insurance company without the involvement of the TPA.

To buy this Plan Click below

DAY CARE TREATMENTS

Covers certain day care procedures like Dialysis, Chemotherapy, Radiotherapy, Cataract Surgery, etc.

NO-CLAIM BENEFITS

For every claim free year, you will be entitled to a bonus of up to 10% of your sum insured.

PRE HOSPITALIZATION

Compensates for the Pre-Hospitalisation expenses for consultations, investigations and medicines incurred up to 30 days before Hospitalisation

POST HOSPITALIZATION

Compensates for a lump sum amount equal to 7% of hospitalization expense (excluding room charges) up to a maximum of Rs.5,000 per occurrence of post-hospitalization expense. Note: In the case of packaged treatments, the post-hospitalization expense is covered within the specified limit after calculating the room rent and boarding charges.

OPD EXPENSE COVER

This plan covers outpatient benefits up to specified limit depending on the sum insured opted and age of the members covered. Please refer the brochure for the details of these limits. The outpatient treatment also includes the cost for pre-existing conditions, dental expenses, pre and post natal care.

TAX BENEFITS

You can avail tax benefits for the premium amount paid towards this plan under Section 80D of the Income Tax Act,1961.

SUM ASSURED ENHANCEMENT

You can apply for the sum increase at the time of renewal. However, there should not be any claim made on the policy for considering the request.

EMERGENCY AMBULANCE

Compensates you up to Rs.750 for each hospitalization towards the emergency ambulance services up to a maximum of Rs.1,500 per policy period.

NEW BORN BABY COVER

Not applicable unless added to the policy post the completion of the eligible age.

FREE LOOK PERIOD

For any reason, should you decide not to proceed with the policy, you can return the same and request for a refund within 15 days from the date of receipt of the policy document.

Star Health Hospital Cash Insurance Policy

Star Health Hospital Cash policy provides additional insurance coverage to take care of any incidental expenses incurred during hospitalization, such as on food, travelling, etc. It is designed to provide extra financial support to the policyholder to cover those medical expenses that are generally not covered under a regular health insurance policy.

Star Health Hospital Cash Policy Overview

Star Health Hospital Cash plan provides a lump sum hospital cash benefit to the insured for the period of hospitalization resulting from sickness or accidental injuries. It offers six types of hospital cash benefits and the policy can be purchased over and above the regular health insurance policy.

The Star Health Hospital Cash plan is available in two variants - Basic and Enhanced plan. While the basic plan offers a hospital cash benefit of Rs 1000/2000/3000 per day, the Enhanced plan Rs 3000/4000/5000 per day as the benefit. The number of hospital cash days ranges from 30 days to 180 days across both plan variants. The applicant can opt for any combination of hospital cash amount and number of hospital cash days as per his/her preference under individual and floater cover.

Star Health Hospital Cash Policy Eligibility Criteria

|

Criteria |

Specifications |

|

Minimum Entry Age |

18 years 91 days (children) |

|

Maximum Entry Age |

65 years 25 years (children) |

|

Plans Offered |

Basic Plan Enhanced Plan |

|

Coverage |

Individual/ Floater |

|

Hospital Cash Amount |

Basic Plan - Rs 1000/2000/3000 per day Enhanced Plan - Rs 3000/4000/5000 per day |

|

Number of Hospital Cash Days |

Basic Plan - 30/60/90/120/180 days Enhanced Plan - 90/120/180 days |

|

Policy Term |

1/2/3 years |

|

Pre-existing diseases waiting period |

2 years (Basic Plan) 3 years (Enhanced Plan) |

|

Deductible |

1-day deductible (Under the Basic plan of sickness hospital cash) |

Key Features of Star Health Hospital Cash Policy

Take a look at the various features and benefits of Star Health Hospital Cash Insurance:

Inclusions of Star Health Hospital Cash Policy

Star Health & Allied Insurance Co Ltd provides the following coverage under the Hospital Cash policy:

10 day care procedures are covered under all kinds of hospital cash benefits except for Convalescence Hospital Cash and Child Birth Hospital Cash. To know the list of covered day care procedures, refer to the Star Health Hospital Cash Insurance policy brochure.

To buy this Plan Click below

Star Outpatient Care Insurance Policy is a popular plan from Star Health Insurance especially designed for covering outpatient expenses. The plan covers medical practitioner expenses, laboratory tests, bills for prescribed medication, etc.

|

Type |

Individual or Family Floater |

|

Sum Insured |

Up to Rs 1 lakh |

|

Renewability |

Lifelong |

|

Tenure |

1 year |

|

Coverage Offered at |

Network Hospitals |

Star Outpatient Care Insurance Policy is available in Individual or Family Floater basis with sum insured amount of Rs 25,000, Rs 50,000, Rs 75,000 and Rs 1 lakh.

The coverage provided are:

Outpatient Consultation: This includes expenses not covered for in-patient specialist visits or day care visits. This considers consultation taken at any network hospital under the insurer.

Expenses for Diagnostics, Physiotherapy, and Pharmacy: The insurance policy covers such costs at a specific diagnostic test or examination to be done at an external laboratory. Additionally, if a patient is recommended physiotherapy treatment for physical injuries, the same will be covered under the policy. Both in-house and external treatment expenses are financed.

In addition to the basic coverage provided, the inclusions for the Star Outpatient Care Insurance policy are as follows:

The features and benefits of the Star Outpatient Care Insurance Policy are:

In the event of portability, the waiting period is reduced accordingly.

To Buy this Plan Click here

Star Young Star Insurance Policy is a health plan that provides coverage to people up to the age of 40 years. It covers medical expenses incurred due to hospitalization, ambulance charges, automatic restoration, mid-term inclusion etc. It also comes with special features, such as no cap on room rent.

| Categories | Specifications |

| Coverage Type | Individual or Family floater |

| Sum Insured | Rs 3 lakh to Rs 1 crore |

| Tenure | 1 year, 2 years, 3 years |

| Cumulative Bonus | 20% for every claim-free year for up to 100% of the SI |

| Road Traffic Accident Benefit | 25% increase in SI up to Rs 10,00,000 |

| Loyalty Benefit | 10% discount for people above 40 years if the policy was purchased before turning 36 |

A person can buy a Star Young Star Insurance Policy on an individual and family floater basis with sum insured options of Rs 3 lakh to Rs 1 crore (on an individual basis) and Rs 5 lakh to Rs 1 crore (on a family floater basis. One can either choose a gold plan or a silver plan under this policy based on their requirements.

The following coverage is offered under Star Young Star Health Insurance policy:

The following is the list of features and benefits that Star Young Health Insurance covers:

To Buy This Click below

Wide Cover

This policy provides wide coverage including self, spouse, dependent children (maximum 3), parents and parents-in-law.

Mid-Term Inclusion

Newly married / wedded spouse, New Born Baby and legally adopted child can be covered under the policy on payment of an additional premium.

Delivery Expenses

Delivery expenses including the Caesarean section (both pre-natal and post-natal) are covered up to 10% of the Sum Insured.

New Born Cover

Hospitalisation expenses for the treatment of newborn are covered from day one of birth till the expiry date of the policy subject to limits. However, the sublimit will not apply for treatment related to congenital disease/defects for the new born.

Automatic Restoration of Sum Insured

On partial or full utilisation of the Sum Insured during the policy period, 100% of the Sum Insured will be restored unlimited number of times in the policy year that can be utilised for all the claims.

Home Care Treatment

Expenses incurred for home care treatment for specified conditions are covered up to 10% of the Sum Insured subject to the maximum of Rs. 5 Lakh in a policy year. The insured person can avail this service either on a cashless or reimbursement basis.

Chronic Severe Refractory Asthma

In-patient hospitalisation, Day Care, Home Care and Outpatient expenses incurred for the treatment of Chronic Severe Refractory Asthma are covered up to 10% of the Sum Insured subject to the maximum of Rs. 5,00,000/- per policy period.

Assisted Reproduction Treatment

Expenses incurred for proven Assisted Reproduction Treatments are covered up to the specified limits.

Diabetes Cover

Specially designed for persons diagnosed with Diabetes, both type 1 and type 2. Along with its complications, other illnesses or diseases are also covered.

Entry Age

Any person aged between 18 and 65 years can avail this policy.

Policy Type

This policy can be availed either on an Individual or Floater basis. Floater basis can be taken only for a family of 2 members.

Flexible Plan Options

Plan A: With pre-acceptance medical examination. Plan B: Without pre-acceptance medical examination.

Outpatient Expenses

Outpatient expenses incurred at Network Hospitals or Diagnostic Centres are covered up to the limits mentioned in the policy clause.

Automatic Restoration of Sum Insured

On exhaustion of the basic Sum Insured during the policy period, 100% of the basic Sum Insured will be restored once during the policy year.

Personal Accident Cover

One person is eligible to avail worldwide personal accident cover at no additional cost.

Instalment Options

The policy premium can be paid on a half-yearly basis. It can also be paid on an annual, biennial (once in 2 years) and triennial (once in 3 years) basis.

To Buy this click below

Unique Product

Specially designed policy for individuals aged between 10 and 65 years who have a history of cardiac ailments.

Flexible Cover

This Policy covers surgical and non-surgical treatments for cardiac and non-cardiac ailments. Cardiac ailments are covered after 90 days.

Policy Term

This policy can be availed for a term of one, two or three years.

Sum Insured

The Sum Insured options under this policy are Rs. 3,00,000/- and Rs. 4,00,000/-.

Personal Accident Cover

Worldwide personal accident cover is provided in case of death due to accidents during the policy period.

Outpatient Cover

Reasonably and necessarily incurred outpatient expenses at Network Hospitals in India are covered up to the limits mentioned in the policy clause.

Instalment Options

The policy premium can be paid on a quarterly or half-yearly basis. It can also be paid on an annual, biennial (once in 2 years) and triennial (once in 3 years) basis.

To Buy this click here!

|

Policy Term This policy can be availed for a term of one year. |

|

Entry Age Any person aged between 5 months and 65 years can avail this policy. |

|

Sum Insured The Sum Insured options under this policy are Rs. 5,00,000/-, Rs. 7,50,000/- and Rs. 10,00,000/-. |

|

In-Patient Hospitalisation Hospitalisation expenses incurred for a period of more than 24 hours on account of illness, injury or accidents are covered. |

|

Pre-Hospitalisation In addition to in-patient hospitalisation, the medical expenses incurred up to 30 days before the date of admission to the hospital are also covered. |

|

Post-Hospitalisation Post-hospitalisation medical expenses up to 60 days from the date of discharge from the hospital are covered up to 2% of the basic Sum Insured per hospitalisation. |

|

Road Ambulance Ambulance charges incurred for transporting the insured person to the hospital are covered by private ambulance services are covered. |

|

Room Rent Room (Single Standard A/C Room), boarding and nursing expenses incurred during in-patient hospitalisation are covered. |

|

ICU Charges ICU charges at actuals are covered under this policy. |

|

Cataract Treatment Expenses incurred for Cataract treatment are covered up to the limits mentioned in the policy clause. |

|

Modern Treatment Modern treatment expenses are covered up to the limits mentioned in the policy clause. |

|

Day Care Procedures Medical treatments and surgical procedures that require less than 24 hours of hospitalisation due to technological advancements are covered. |

|

Rehabilitation & Pain Management Expenses incurred for Rehabilitation and Pain Management are covered up to the specified sub-limit or the maximum up to 10% of the basic Sum Insured, whichever is less, per policy period. |

|

Hospice Care For cancer patients with advanced life-limiting cancer, 20% of the Sum Insured is payable for compassionate care at Network Hospitals after the completion of 12 month waiting period. |

|

Co-payment If the insured person purchases or renews the policy at 61 years of age or above, then he/she is subjected to the co-payment of 10% for each and every claim amount. |

|

Cumulative Bonus Cumulative bonus is provided at 5% of the Sum Insured for each claim-free year subject to a maximum of 50% of the Sum Insured. |

|

Second Medical Opinion The Insured person can avail a Second Medical Opinion from a Doctor in the Company's network of Medical Practitioners. |

|

Health Check-Up Expenses incurred for health check-up are covered up to Rs. 2500/- for every claim-free year. |

|

Wellness Services This program intends to promote, incentivize and to reward the Insured Persons' healthy life style through various wellness activities. |

|

Instalment Options This policy premium can be paid on a quarterly or half-yearly basis. |

Like other critical illness plans, the Star plan too is a benefit plan that provides a lump sum payout on the first diagnosis of a listed critical illness. Here are the main features of the plan.

For this policy, the 37 critical illnesses covered are grouped into 4 categories:

The plan will make a maximum of one lump-sum payout per category in a lifetime. It allows for one claim under each of the 4 categories as long as there is a waiting period of 12 months between 2 claims and there is only one claim per policy year.

If a claim has been made for a critical illness, the cover will be renewable for critical illnesses under the other 3 categories. If a claim is made for multiple critical illnesses at the same time, then a payout will be made only towards one group.

It comes with lifelong renewability as long as there is at least one section where no claim has been made.

Cardiac Cover

Specially designed policy for individuals aged between 7 and 70 years who are diagnosed with cardiac ailments and treated with cardiac surgical intervention.

Non-Cardiac Cover

Hospitalisation and Day Care expenses due to non-cardiac ailments and accidents are covered up to the Sum Insured.

Sum Insured

The Sum Insured options under this policy are Rs. 5,00,000/-, Rs. 7,50,000/-, Rs. 10,00,000/-, Rs. 15,00,000/-.

Cumulative Bonus

Cumulative bonus is provided at 10% of the basic Sum Insured for each claim-free year subject to a maximum of 100% of the opted Sum Insured.

Cardiac Devices

Expenses incurred on cardiac devices like Pacemaker, CRT-D and AICD are covered up to 50% of the Sum Insured.

Heart Transplantation

Expenses incurred towards harvesting and transportation of heart by road or air are covered up to 200% of the basic Sum Insured.

Instalment Options

The policy premium can be paid on a quarterly or half-yearly basis. It can also be paid on an annual, biennial (once in 2 years) and triennial (once in 3 years) basis.

Policy Term

This policy can be availed for a term of one, two or three years.